Hello out there! Yes, I am alive. I have been super busy with the new job (love it!) and have taken a long break from posting or market work to be focused on the new gig. I did want to pop in tonight and post a quick chart and some thoughts I have as we could be on the eve of a new round of some kind of Quantitative Easing, Twist, Running Man, or whatever dance move the Fed would like to name it.

QE and the Trap of Diminishing Returns

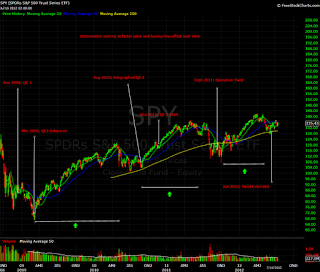

First off, the chart of SPY and interventions notated (click for larger view):

Some quick points:

-The time from QE/Intervention application to when market faces trouble is getting smaller over time

-The almost fractal like repeat of the pattern is worth noting as the arcs get smaller (three shown above)

-Fed support for market is coming at progressively higher prices

-The time from when SPY closes below the 50 MDA until Fed action is getting compressed (they chartists over there?)

My take away from this chart (been looking at it a bit lately) is that there is considerable interest by the Fed and extension Wall Street in limiting any damage to equity markets. I know, shocking right. I think besides that obvious point what I take away from this is the Law of Diminishing Returns is clearly at work. I could go on and on but seems at this point the setting of a absolute floor under the SPY and a general area of a top end target would be more effective and up front than the current process of trying to calm "panic" when stocks fall.

Long time readers know I am against QE and most market support by the US Fed. By a fortuitous meld of circumstances the kind of support the markets are getting keeps on trucking. My question is how many more and how much more is going to be needed with compression of the price reaction getting smaller?

Have a good night.

8 comments:

Fantastic observations! If I had more time to study fractals we could clearly see it all in full view.

He was the genius behind it all:

http://en.wikipedia.org/wiki/Benoit_Mandelbrot

Glad to hear you love your new job and it's always nice seeing you check back in with the cold hard facts.

I don't want to put anyone into panic mode but it's too late, so...

http://youtu.be/ORSxBUGRX5A

"It's" going to happen no matter what now. What ever "it" is, it will be bad...economic...etc.

For Friday night:

http://youtu.be/6DUlikjWhxw

Until you post again my friend.

G

I'm glad you're enjoying your new job. I know how difficult it is to switch careers.

But this is what has been going on in my own little corner of the world.

I got this assignment last month. Did the research, found the house, blah, blah, blah, wrote a price opinion. This house needs a new roof, has structural damage, cracked stucco, missing appliances, it doesn't even have a bathtub. So, comparable sales, minus reductions for repairs, I couldn't price this house at over land value, $16,000. That ought to tell you about the quality of construction and condition of the house.

I put it on MLS. Within 4 days, we had over 80 veiwings, countless phone calls, and multiple offers.

The highest bid was $21,000. Sold.

Here's the thing. This idiot is a Realtor! He said he's tired of living in his mother's garage. Hey, if you've got $21,000 cash--this has to be a cash deal, because no bank is going to make a loan on this property--rent an appartment! For crying out loud.

I don't know if this idiot lives in his mohther's garage or now. I do know that he's a fool. There is a reason why the house is priced at lot value. It would be cheaper to bulldoze the house and build a new one, than it would cost to repair the house and re-sell it.

But that's what this guy is thinking. Flip the house. Um, idiot, you are now responsible for proptery taxes--and do you think the county values this house at

$16,000? No. More like $60,000.

So you're going to pay $21,000 for a $16,000 lot, pay property taxes on at least three times that much, make the necessary repairs, which will cost several thousand dollars, and expect to make a profit on the re-sale?

This is insane. But, hey, the guy wanted to buy the property. He had the highest bid. I sold it to him. Not my problem. I did my job.

Caveat emptor

G

Always a great pleasure and surprise to see you G! Thanks so much for reading. Appreciate it.

Gawains, well maybe it's really terrible in Mom's garage and he needs OUT! LOL Hey, you did your job.

No, it's not my problem. My problem was finding the house to begin with, then walking through it and trying to figure out WTF happened. (The idiot builder was cheap and couldn't build a house tht was worth more than the land it was on.)

My problem was finding comps, making adjustments, and trying to find out what this house is really worth, which would be nothing.

These people, they're so stupid. They think that because it's cheap, they can fix it up and turn a profit. Good luck with that.

I'm looking at at least $50,000 in repairs. That's why I couldn't justify a price above lot value. Some fool wants to buy it, pour tens of thousands of dollars into it, in the desperate hope of re-selling it for a profit? Not my problem.

I did my job. I found the house. I wrote the price opinion. I put the house on the market. Some stupid fool wants to pay $5000 over list price, hey, I'll gladly take the commission. 3% of $21,000 is more than 3% of $16,000.

I don't have anything to complain about. This fool will, after he pours everything he has into a dump all just to sell it for a loss.

Here's what I know about real estate. No. 1, you buy a house to live in it. A well-built house in a nice neighborhood with good schools, that's gold. You can sell that at any time and recover your equity. But if you want to get rich. . . .

Imagine a triangle.

Mc (shopping)

/ \

Ed-----Ms (schools)

(courthouse,

university)

Now, where is the most valuable land? It's in the center, because all of these towns are going to grow toward the center.

This is the secrect of real estate. You buy undeveloped land on the outskirts of towns, zone it agricultural--lowest taxes--sit on it and wait for growth and development. When that land is worth more than ten times what you paid for it, then sell.

Flipping houses is for fools. You have to have a team--contractors, plumbers, electricians, a/c repairmen, realtors--if you hope to make a profit.

30 years ago, my mother had two offices. One in Ed and another in Mc. She came to the realization that she was paying twice the business expenses and not selling twice the real estate.

So she closed both offices, the one across from the courthouse and the other downtown on 10th Street, and bought an old ranch house in the center of it all.

She was smart. There was nothing but vacant land all around. 30 years later, there's a new grocery store, new restaurants, a new subdivision across the street. Suddenly, that land, 7 acres of undeveloped real estate, that she paid $250,000 for is worth $400,000 an acre. That would be $2.6 million. Plus the company, plus the listings, add another several million.

That's how you make money in real estate. It's not about owning the company. It's about buying land where groth and development will come.

Flipping houses is for fools.

I did some additional research and found out that the county taxes this house at $105,000. Think about that for a minute.

Anyone who thinks this dump of a poorly constructed house is worth that much is brain dead. This is my problem with county appraisers. They don't go into the house! They only do a drive by.

Hello, there's a hole in the ceiling. There's no bathtub, no appliances. This house is unliveable. Beyond that, if you couldn't notice the cracks in the stucco walls and the missing shingles on the roof, by what possible logic could you justify a valuation of $105,000? It's barely worth the value of the land it's on.

But that's not what bothers me. I know these appraisers. Our partner is the head of the appraisal district. They just drive by and say, oh, this house is worth so much. They're overvaluing properties to increase tax revenues. They work for the county.

It's this idiot buyer, who happens to be a Realtor. What, you're going to spend $21,000 cash for a $16,000 lot with a poorly constructed, unliveable dump of a house on it, so you can pay property taxes on $105,000 while you spend at least another $100,000 either on repairs, utilities and maintenance, or bulldozing the house and building a new one. And this is your brilliant scheme for making money?

Give me a break. But, yeah, I'll sell you the house. $5,000 over list price only increases my commission. It's your problem then.

Don't know if you still do Friday rock blog requests but this one is right up you line of work...

http://youtu.be/wxDOpAM2FrQ

Symphony of Science - The Greatest Show on Earth! A music video about Evolution

G

Start early. American Nurses Credentialing Center: Psychiatric and Mental Health Nurse Certification Application Feeling like you are home too early can be just as bad as feeling homesick whilst there so it's important to get the length of contract right.

Post a Comment